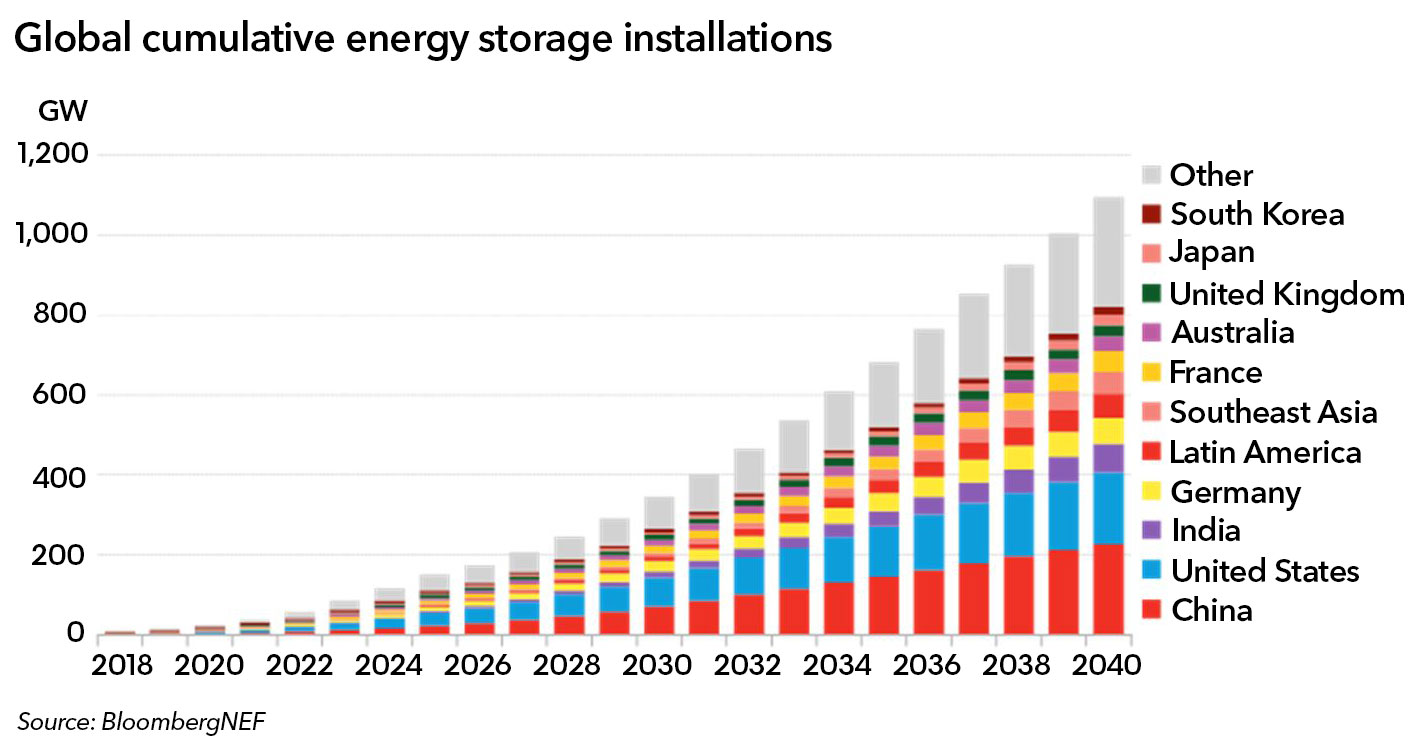

Global energy storage systems are set to grow exponentially from 9GW/17GWh deployed as of 2018 to 1,095GW/2,850GWh by 2040, according to BloombergNEF .

BNEF estimates that the 122-fold increase in energy storage will require $662 billion of investment.

In a report published on 7/31/19 by BNEF titled Energy Stoage Outlook 2019, the research company predicts a further halving of lithium-ion battery costs per kilowatt-hour by 2030.

This steep reduction in battery prices is attributed to two main factors: stationary storage and electric vehicles.

“Two big changes this year are that we have raised our estimate of the investment that will go into energy storage by 2040 by more than $40 billion, and that we now think the majority of new capacity will be utility-scale, rather than behind-the-meter at homes and businesses,” said Yayoi Sekin, an energy analyst for BNEF and co-author of the report.

As battery prices fall, researches predict an increase in the use of batteries across different application such as energy shifting, dealing with demand spikes, and by customers interested in reducing energy costs by buying electricity during cheaper hours and saving it for later use.

Logan Goldie-Scot, head of energy storage at BNEF, added: “In the near term, renewables-plus-storage, especially solar-plus-storage, has become a major driver for battery build. This is a new era of dispatchable renewables, based on new contract structures between developer and grid.”

By 2040, China and the U.S. are set to be the leaders in cumulative energy storage installations.

BNEF predicts that renewables will account for nearly 40% of the world’s electricity by 2040.

Renewables eclipsed coal production for the first time ever this past April when clean energy sources generated nearly 68.5 million megawatt-hours of power.

Go here to learn about Dynapower’s energy systems, inverters and DC-DC converters.